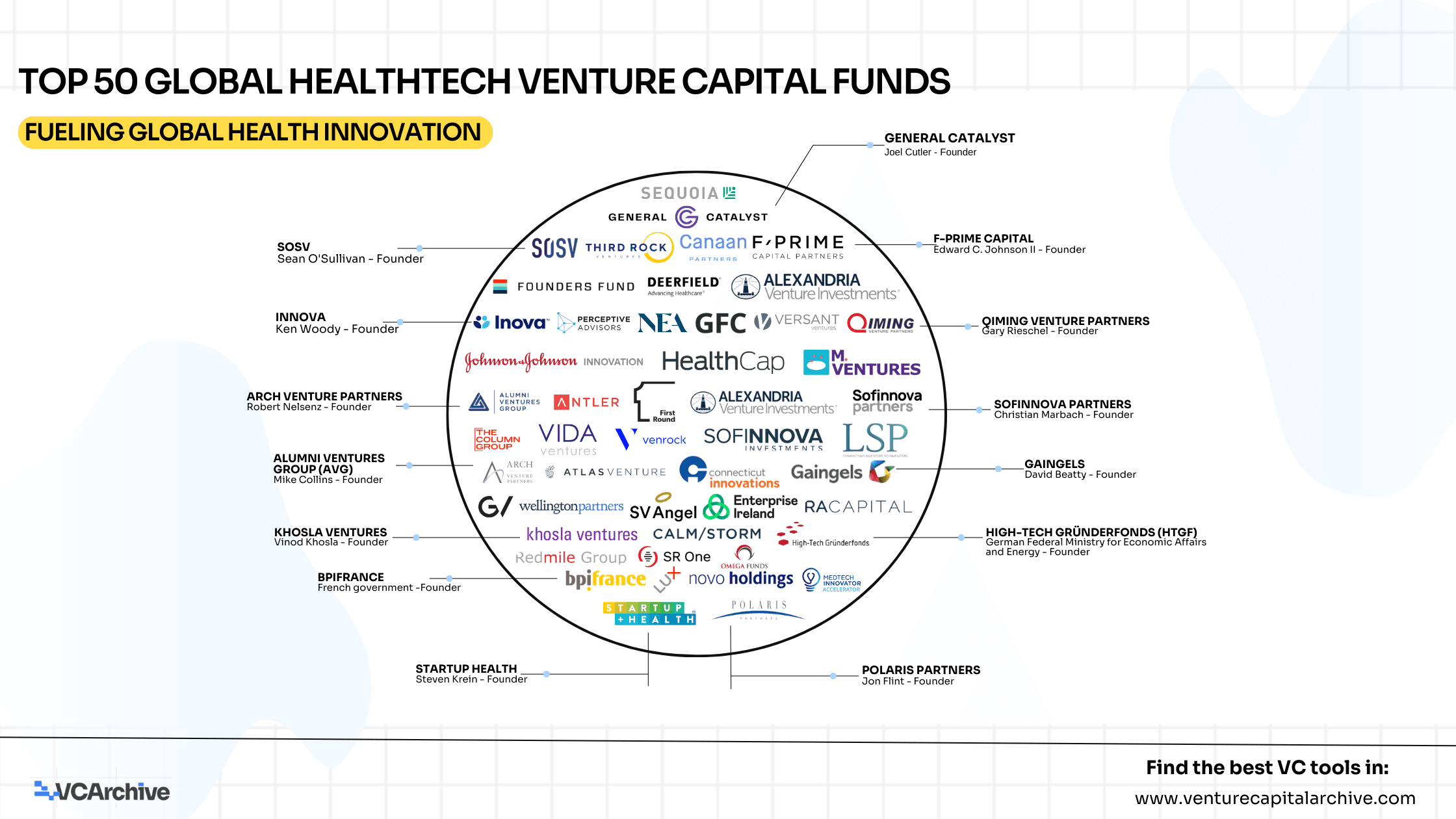

Top 50 Active Global Healthtech VC Funds

Among the most prominent names are SOSV, known for its global deep tech focus and accelerator programs like IndieBio; ARCH Venture Partners, a pioneer in science-driven biotech investment with a long history of backing transformative research; and Novo Holdings, the investment arm of the Novo Nordisk Foundation managing €140 billion in assets with a strong life-sciences mandate.

Other leaders include General Catalyst, combining multi-stage capital with sector-wide collaboration, and Khosla Ventures, which boldly invests in disruptive, founder-first innovations across health and frontier technologies.

These funds collectively invest across all stages from pre-seed and seed rounds that nurture pioneering ideas, to growth-stage capital fueling scale and commercialization. They bring not only capital but also deep domain expertise, operational support, and global networks critical for navigating complex regulatory environments and achieving lasting impact. Their portfolios cover cutting-edge therapeutics, digital health platforms, advanced diagnostics, and innovative medical devices, highlighting the broad and sophisticated nature of modern HealthTech investing.

Geographically, hubs like San Francisco, Boston, Menlo Park, Paris, London, Munich, Copenhagen, and Shanghai dominate deal flow and capital deployment, reflecting the world's most active innovation centers. Alongside independent VC firms, government-backed entities such as Enterprise Ireland and corporate venture arms like Johnson & Johnson Innovation play significant roles, underscoring the ecosystem’s diverse capital sources.

Key industry trends emerge from this landscape:

- Multi-stage funding approaches ensuring continuous support from early discovery through scale.

- Strong emphasis on ESG and impact measurement, aligning investments with improved health and social outcomes.

- Active follow-on investment policies demonstrating confidence and sustained commitment.

- Increasing global collaboration, with portfolio companies and fund operations crossing borders to harness international expertise and markets.

For founders, this means access to partners who bring a blend of financial resources, scientific rigor, and strategic guidance essential for transforming ideas into market-leading solutions. For investors and stakeholders, these funds represent vital engines fueling innovation to tackle critical health challenges worldwide.

This curated view of the HealthTech VC landscape in 2025 reflects a mature, deeply specialized, and globally interconnected ecosystem. It highlights how venture capital remains indispensable in accelerating scientific breakthroughs into scalable healthcare innovations that have the power to improve lives across the globe, the future of health technology is being forged today.

Explore the full list of Top 50 Active Global Healthtech Venture Capital Funds, including their sector focus, stage, fund size, and global HQ - now live on VCArchive.

Top 50 Active Global Healthtech VC Funds

Rows per page